Exclusive Coverage of Mamaearth IPO: Fundamentals Insights and Numerology Projections

Mamaearth IPO Brief

Mamaearth recently launched its initial public offering (IPO), totalling Rs 1,701.00 crore, incorporating a fresh issue of Rs. 365 crore and an offer for the sale of 4.12 crore shares. The IPO bidding window opened on October 31, 2023, and it will close on November 2, 2023. By Tuesday, November 7, 2023, allotments should be completed. The anticipated listing date for Mamaearth’s IPO on both the BSE and NSE exchanges is scheduled for Friday, November 10, 2023

The price band for the Mamaearth IPO is set at ₹308 to ₹324 per share, with a minimum application lot size of 46 shares requiring a minimum investment of ₹14,904 for retail investors. Moreover, for sNII, the minimum lot size investment is 14 lots (644 shares), amounting to ₹208,656, and for hNII, it is 68 lots (3,128 shares), totalling ₹1,013,472. Additionally, the issue has set aside up to 34,013 shares for employees at a discounted rate of Rs 30 to the issue price.

IPO Document | Company Official Website

Table of Contents

About Mamaearth

Honasa Consumer Private Limited, the company behind the widely acclaimed brand Mamaearth, is an Indian personal care enterprise dedicated to providing natural and chemical-free products. Founded in 2016 by Varun and Ghazal Alagh, Mamaearth has garnered significant acclaim for its eco-conscious and sustainable approach to skincare and haircare solutions.

The brand’s extensive product range, spanning from infant care to beauty and well-being, has struck a chord with health-conscious consumers seeking safe and organic alternatives. Mamaearth’s emphasis on transparency and ingenuity has not only fostered a loyal customer base but has also positioned it as a pioneering advocate of eco-friendly practices in the beauty and personal care sectors.

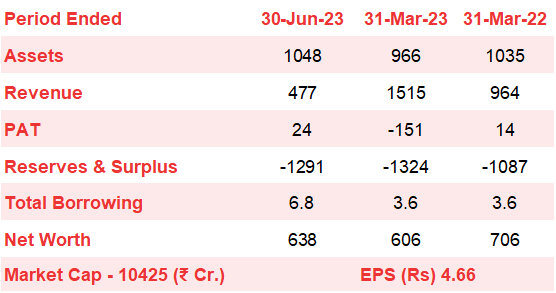

Financial Health of Mamaearth (Consolidated)

The assets of the company have been growing steadily, indicating potential expansion. However, revenue has experienced a significant decline, possibly due to market adjustments or operational challenges. The fluctuating profit after tax (PAT) shows that the company has been profitable recently, which can be attributed to better cost management. Moreover, the reserves and surplus of the company reflect ongoing efforts to enhance financial stability. The market cap indicates investor confidence, while the EPS highlights stable earnings per share.

Objectives of Mamaearth IPO

The proposed use of the net proceeds concludes with the following items:

- Enhancing brand visibility via advertising campaigns (182 Crore)

- Capital investment for the setup of new EBOs (20.6 crore)

- Investment in the subsidiary, BBlunt, for new salon ventures (26 Crore)

- Meeting general corporate requirements and undisclosed external acquisitions (Remaining proceeds)

Positive Aspects of Mamaearth IPO

- Young and talented management with a clear vision for company growth

- Complete digitalization of the distribution channel.

- Focused on brand building with an environment and customer-friendly products.

- The product line includes a wide range of items that cater to the beauty and infant care niches.

- Mamaearth’s brand name adds up to a favorable numerology total of 9 (27), which brings fame and power.

Concerning Aspects of Mamaearth IPO

- Cases related to product liability and claims

- The company’s product line is heavily reliant on external vendors, which is a significant factor to consider.

- The company’s profit, as well as its reserve and surplus, are not in a favorable position.

- Leading players such as Hindustan Unilever, Procter & Gamble, and L’Oréal pose a tough challenge to Mamaearth.

- Rising costs can have a negative impact on the company’s profit margins.

Exclusive Numerology Insights of Mamaearth IPO and Mamaearth Share Price

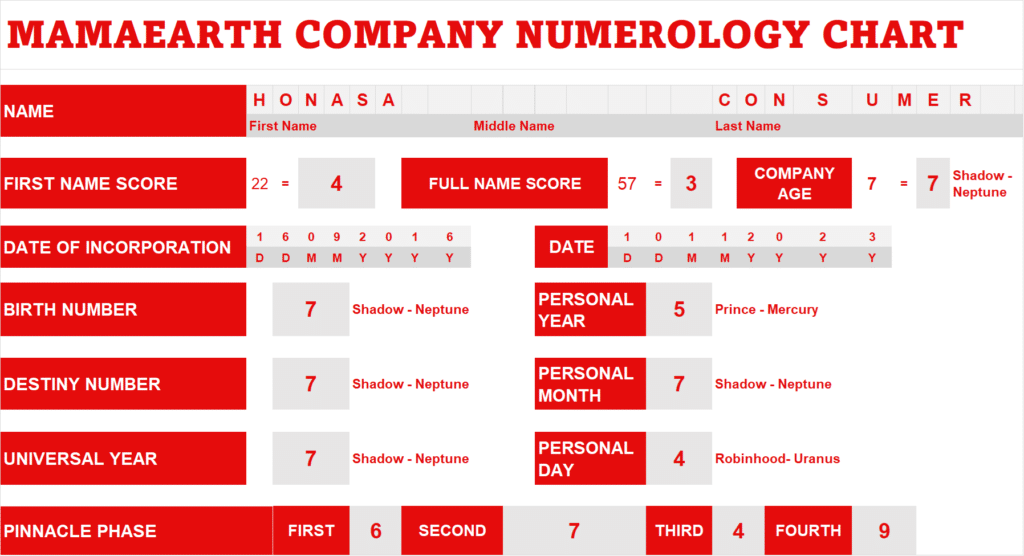

Numerology Analysis of Mamaearth Company

It’s surprising to know that Mamaearth Company has the same Birth Number 7 and Destiny Number 7, according to the numerology of its date of incorporation. The number 7 is associated with the planet Neptune (Ketu) in numerology, which suggests a lack of self-existence and dependence on others for the way forward. Additionally, the number 7 indicates volatility and other numerological aspects that we have already covered in our previous post about Tesla.

If you look closely at the above numerology chart, you’ll see that the number 7 appears multiple times, such as the birth number, destiny number, universal year, running company age, and personal month when the company plans to launch its IPO. An excess of 7 indicates disappointment and a lot of effort to prove credibility.

According to the numerology chart of the company, there are no positive vibes for the month of November 2023 for the IPO launch. However, the birth number and destiny number 7 also reflect disappointment in relationships, so the company should take care of its employees or staff members by focusing on retention and personal development.

The essence of the Mamaearth company numerology chart suggests that there are more challenges ahead for the company, but if they work diligently to overcome them, they can overcome them and create their uniqueness. The current year, Personal Year 5, is positive for Mamaearth as it brings opportunities to expand its product line and helps the company secure funding. According to numerology, it is advisable for Mamaearth to focus more on social corporate responsibility and contribute to spiritual causes, which can uplift the company’s progress.

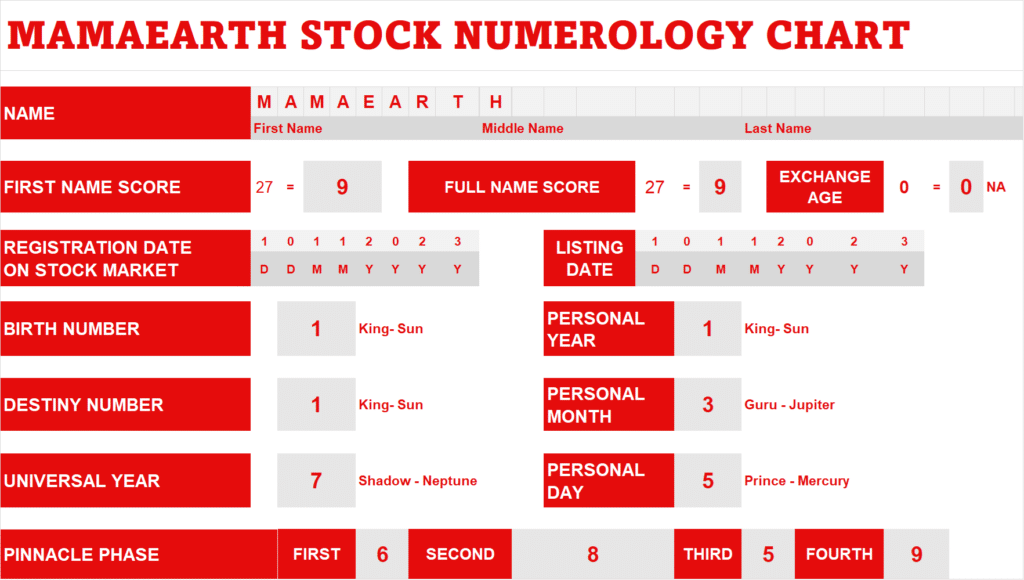

Numerology Analysis of Mamaearth IPO Share Price according to Listing Date

If we refer to the numerology chart of Mamaearth based on its listing date of November 10, 2023, we can see that it has the same Birth Number 1 and Destiny number 1 (King) with a personal year of 1 and a personal day of 5. (refer to our GMR post for birth number 1 detail)

Although the listing date can vary according to exchange proceedings, we can consider this a new beginning for Mamaearth IPO, with a positive start for the next couple of months. However, there are various factors that we will need to consider, depending on the final listing date. Next year, 2024, due to personal year 2 (Moon), feelings and emotions may have an impact on traders and investors, which could ultimately affect Mamaearth’s future. We will cover this in our exclusive post on Mamaearth Share Price in 2024.

Post Disclaimer: Our team would like to clarify that we have no intention to hold Mamaearth Stock directly or indirectly through any ETF or mutual funds, and all projections made in this report are based on different parameters. As price predictions can vary, we urge you not to make any trades or investments based solely on our report unless you have a strong conviction in the stock or company.

Frequently Asked Questions: Mamaearth IPO

What are the lot size and minimum order quantity for the Mamaearth IPO?

46 Shares Lot Size

Where will Mamaearth’s IPO get listed?

NSE & BSE

What will be the Mamearth share price target in 2023?

Considering Numerology factors, It will trade below 600

What will be the Mamearth share price target in 2024?

Taking into account a number of numerology factors, a sharp decline is visible; however, we will also provide guidance based on technical analysis at a later date.