Exclusive Coverage on Coal India Earnings: Q2 FY24 Conference Call

Contents

Concall Summary of Coal India Earnings

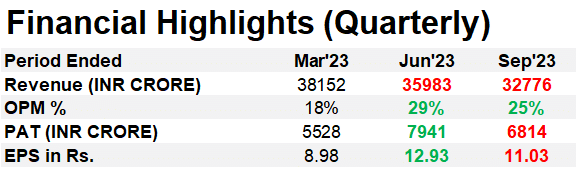

Coal India Limited’s Q2 FY24 earnings call reveals a commendable financial performance, marked by a substantial 9.9% YoY increase in revenue from operations, reaching ₹32,776 crore. The net profit surged impressively by 12.7% YoY, attaining ₹6,814 crore, reflecting robust financial health. The noteworthy EBITDA margin stood at 30%, showcasing operational efficiency.

Operational successes are highlighted by heightened power demand during H1 FY24, contributing to improved average realizations, increased coal production, and higher dispatches. However, challenges arise from increased other expenses due to provisions for a loss-making joint venture.

The company’s strategic initiatives include significant capex investments, approval of four coal mining projects, and ongoing infrastructure development for coal evacuation. While the revenue from FSAs and e-auctions demonstrates resilience, a focus on cost reduction is evident. Despite positive strides, prudent management of joint ventures and market dynamics in specific segments pose challenges. The company remains optimistic about future demand in the power and steel sectors, emphasizing a commitment to shareholder value through dividend declarations.

Financial Performance Highlights (Q2 FY24 – Coal India Earnings)

- Q2 FY24 showcased stellar financial growth for Coal India Limited, with a 9.9% YoY surge in revenue from operations, reaching ₹32,776 crore.

- The company achieved a notable 12.7% YoY increase in net profit, totaling ₹6,814 crore, underscoring robust financial health.

- EBITDA margin stood at an impressive 30% in Q2 FY24.

Operational Successes (Q2 FY24: Coal India Earnings)

- H1 FY24 witnessed heightened power demand, contributing to the company’s robust performance marked by improved average realizations, increased coal production, and higher dispatches.

- Net receivables as of September 30, 2023, amounted to ₹15,604 crore, reflecting strong financial management.

- The board declared an interim dividend of ₹15.25 per share, emphasizing commitment to shareholder value.

Business Achievements (Q2 FY24: Coal India Earnings)

- As of September 30, 2023, total coal production reached ~333 million tons, a significant YoY increase from 299 MT.

- H1 FY24 off-take of raw coal surged by ~9% YoY to 361 MT, with approximately 80% directed to the power sector.

- Washed coal (coking) generated ₹1,314 crore in revenue during H1 FY24, achieving an average realization of ₹11,768 per ton.

Strategic Updates (Q2 FY24: Coal India Earnings)

- In Q2, a capex of ₹4,494 crore was invested, contributing to the FY24 target of ₹16,500 crore, primarily focused on land acquisition.

- Approval of four coal mining projects in H1 FY24 with a total capacity of 59.5 MTY reflects strategic expansion.

- Ongoing construction of railway lines for coal evacuation in Chhattisgarh and Shivpur indicates a commitment to enhancing infrastructure.

- A significant project to upgrade the mechanized coal transportation system with an investment of ₹24,750 crore is underway.

Revenue Sources & Future Outlook – Coal India Limited

- H1 FY24 revenue from fuel supply agreements (FSAs) and e-auctions reached ₹49,577 crore and ₹10,511 crore, respectively.

- The company anticipates ~90% e-auction premium, driven by steady demand, and aims for ~15% production volume from e-auctions in H2 FY24.

- Solar projects under the subsidiaries CIL Solar PV Limited and CIL Navikarniya Urja Limited are planned for phased execution in the coming years.

- Future strategies focus on volume growth in coal production and dispatches, anticipating significant demand from the power and steel sectors. Cost reductions in evacuation and transportation charges is also on the agenda.

Coal India Financials

Technical Analysis Score of Coal India

Post Disclaimer: Our team would like to clarify that we have no intention to buy or trade in this stock, i.e., Coal India Limited, directly or indirectly, and all projections made in this report are based on different parameters. As price predictions can vary, we urge you not to make any trades or investments based solely on our report unless you have a strong conviction in the stock or company.

You are always welcome to visit the Event Seer News website for the latest updates on company earnings calls.

Well said !