Dow Jones Projections: Exclusive Report by Event Seer News

Explore monthly trends for January 2024 with our expert blend of numerology and Technical Analysis. Unlock insights for strategic options or futures or stocks trading under Dow Jones 30 Indices (DJIA).

Contents

At Event Seer News, our focus is on long-term investing and positional trading rather than short-term equity or option futures trading. However, we also post updates or exclusive hidden insights on indices, which may or may not help the traders trade the weekly and monthly options under the Dow Jones Industrial Average (DJIA).

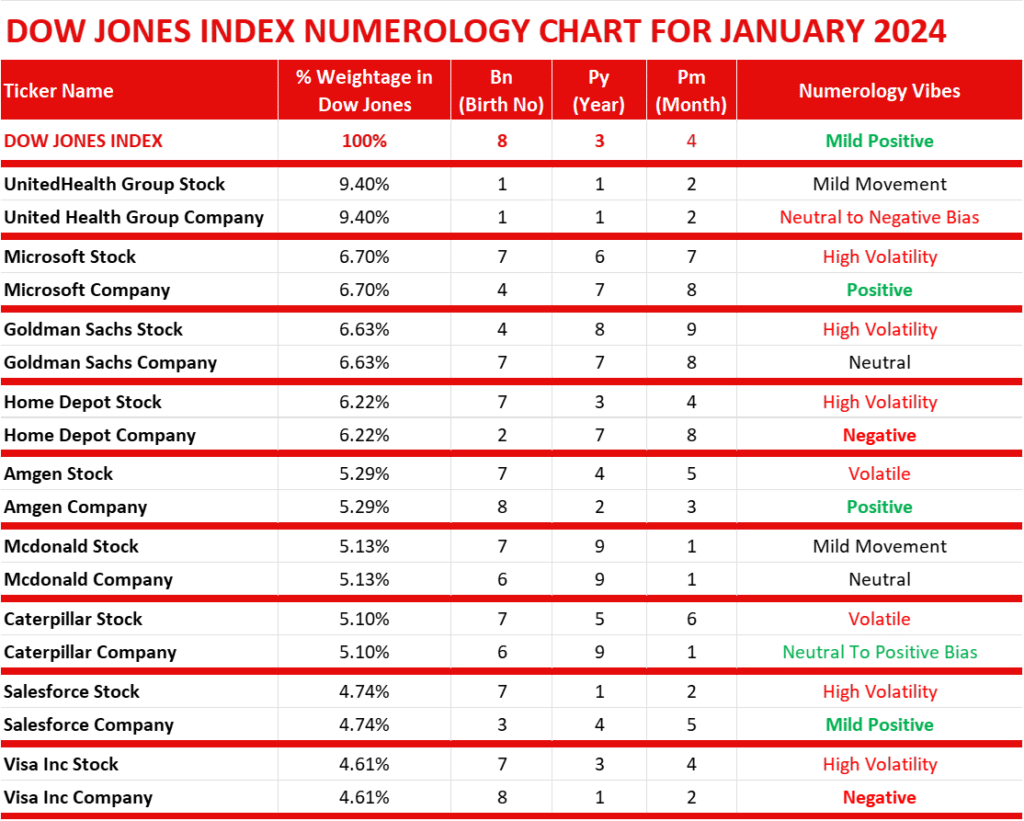

Numerology Analysis of the Dow Jones Industrial Average Index

In the above Numerology Table, we can see that the Dow Jones Index is looking positive as the Personal month is on Number 4 (Uranus Planet), which is good for the stock market but can be volatile. This is positive for Dow Jones Birth Number 8 (Saturn Planet). When both have a temporary relationship, it is considered positive numerologically.

However, the Dow Jones Index is known for its volatility, so checking the levels before trading is important. In this post, we will also cover the technical levels. We took major components that cover more than 50% of the weightage of the Dow Jones Industrial Average Index.

Our overall rating numerologically for the Dow Jones Index is mildly positive for January 2024.

United Health Group (UNH) is looking neutral to mildly negative this month numerologically, as Number 2 is going to meet Number 2, which doesn’t highlight positive movement in a stock.

Microsoft (MSFT) is looking mildly positive this month, numerologically, as Number 4 is going to meet Number 8, which creates a good temporary relationship.

Goldman Sachs (GS) is looking neutral this month, numerologically.

Home Depot (HD) is looking negative this month, numerologically, so short-term traders stay cautious.

Amgen (AMGN) is looking positive this month, numerologically, but it could be highly volatile, so invest or trade accordingly.

Mcdonald’s (MCD) is looking neutral this month, numerologically.

Caterpillar (CAT) is looking mildly positive this month, numerologically, but it could be highly volatile, so invest or trade accordingly.

Salesforce (CRM) is looking mildly positive this month, numerologically, but it could be highly volatile, so invest or trade accordingly.

Visa Inc (V) is looking negative this month, numerologically, so short-term traders stay cautious.

Technical Analysis of the Dow Jones Industrial Average Index

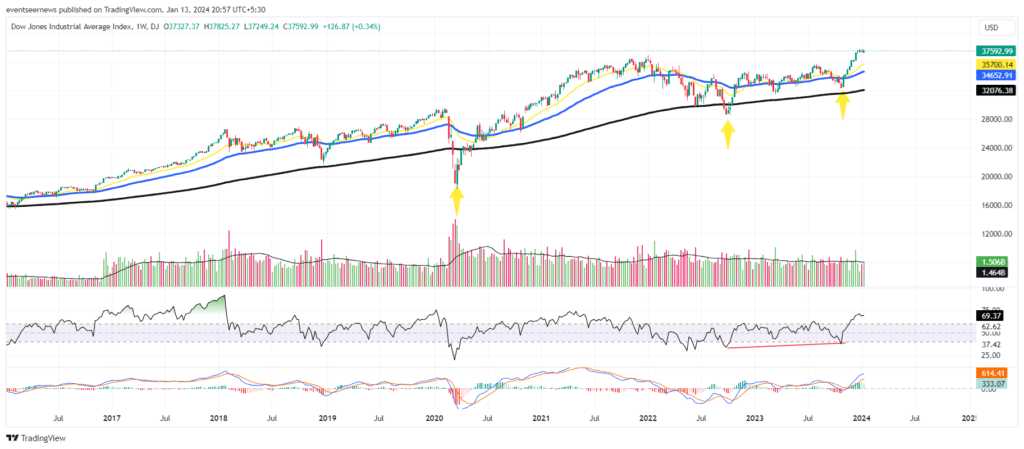

Monthly Chart of Dow Jones Index

The monthly chart of Dow Jones has shown a positive or upside movement since its sudden fall in 2020, which breached the black-coloured EMA 200 on a monthly timeframe (refer to the 1st arrow from left to right). During the excessive inflation surge in 2022, Dow Jones also found support from the black-colored EMA 200 (refer to the 2nd arrow from left to right) and moved upwards, but the levels are higher than those of the COVID-19 fall in 2020. You can refer to the yellow-marked arrow above for a better understanding.

The monthly RSI (middle of the chart above) shows a positive divergence from July 2022 to December 2023, which indicates further upside, leading to an all-time high for the Dow Jones Index.

However, January 2024 will not be cleared on the monthly chart, so let’s move down to the daily chart of DJIA for more insights.

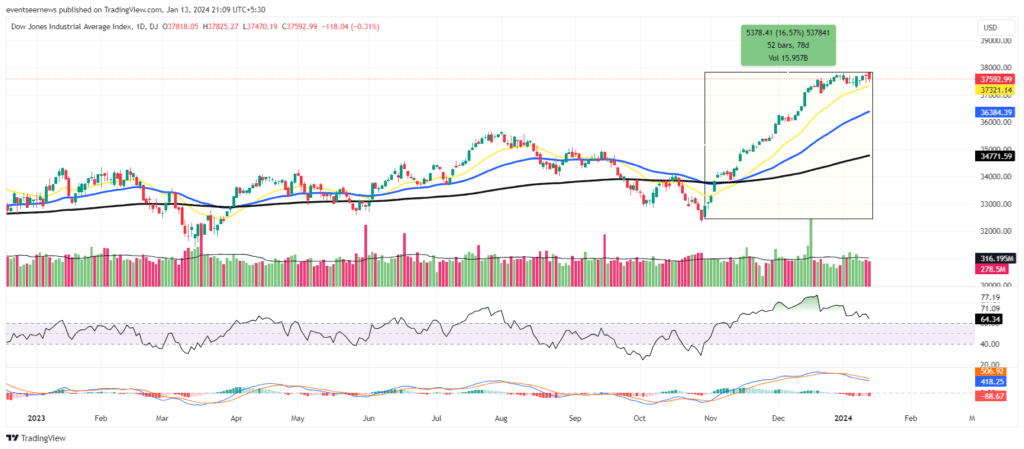

Daily Chart of DJIA

The daily chart of Dow Jones has been showing a consistently bullish trend since November 2023, providing almost 17% returns to its investors or traders on index-based ETFs. However, the Relative Strength Index (RSI) is currently trying to take support on the 60 levels, which will determine its future moves. Despite this, the RSI is still in positive territory.

If Dow Jones closes below 37280, it will enter a negative trend, which can further lead to a downtrend upto 36300 levels. On the other hand, if it goes above 37700, it can move swiftly and provide positivity towards index buyers. As we have numerologically highlighted that Dow Jones is looking mildly positive, there are high chances of consolidation this month.